The Role of Behavioral Finance in Investment Decision-Making

In the world of investment, there’s more to success than just crunching numbers and following market trends. The human element plays a significant role in shaping investment decisions. Behavioral finance is the field that explores the psychological factors that influence these decisions. By understanding the intricacies of behavioral finance, investors can make more informed choices and potentially improve their investment outcomes. In this blog, we’ll delve into the fascinating world of behavioral finance, explore its key concepts, and discuss its vital role in investment decision-making.

Understanding Behavioral Finance

At its core, behavioral finance combines principles from psychology and economics to study how people make financial decisions. Traditional economic theory often assumes that individuals are perfectly rational and make decisions solely based on information and logic. However, behavioral finance recognizes that human behavior can be driven by emotions, biases, and cognitive errors. These factors often lead to irrational decision-making, impacting investment outcomes.

Emotions and Investing

One of the key aspects of behavioral finance is the influence of emotions on investment decisions. Emotions such as fear and greed can lead investors to make impulsive choices, like selling stocks during a market downturn or buying into a market bubble. This emotional rollercoaster can lead to significant financial losses.

Overconfidence and Confirmation Bias

Overconfidence is a common behavioral bias that leads individuals to overestimate their own knowledge and abilities. In the context of investment, this can result in excessive trading, overinvestment in a single asset, or taking unnecessary risks. Confirmation bias, on the other hand, involves seeking out information that aligns with one’s existing beliefs while ignoring contrary evidence. These biases can cloud judgment and lead to suboptimal investment decisions.

Loss Aversion

Loss aversion is another psychological phenomenon that plays a significant role in investment decision-making. People tend to feel the pain of losses more intensely than the joy of gains. This can lead to a reluctance to sell underperforming assets, even when it may be in their best interest to do so.

The Herd Mentality

Humans are social creatures, and this is reflected in investment markets. The herd mentality is a behavioral tendency where investors follow the crowd rather than making independent decisions. This can lead to bubbles and crashes in the market, as well as missed opportunities and excessive risk-taking.

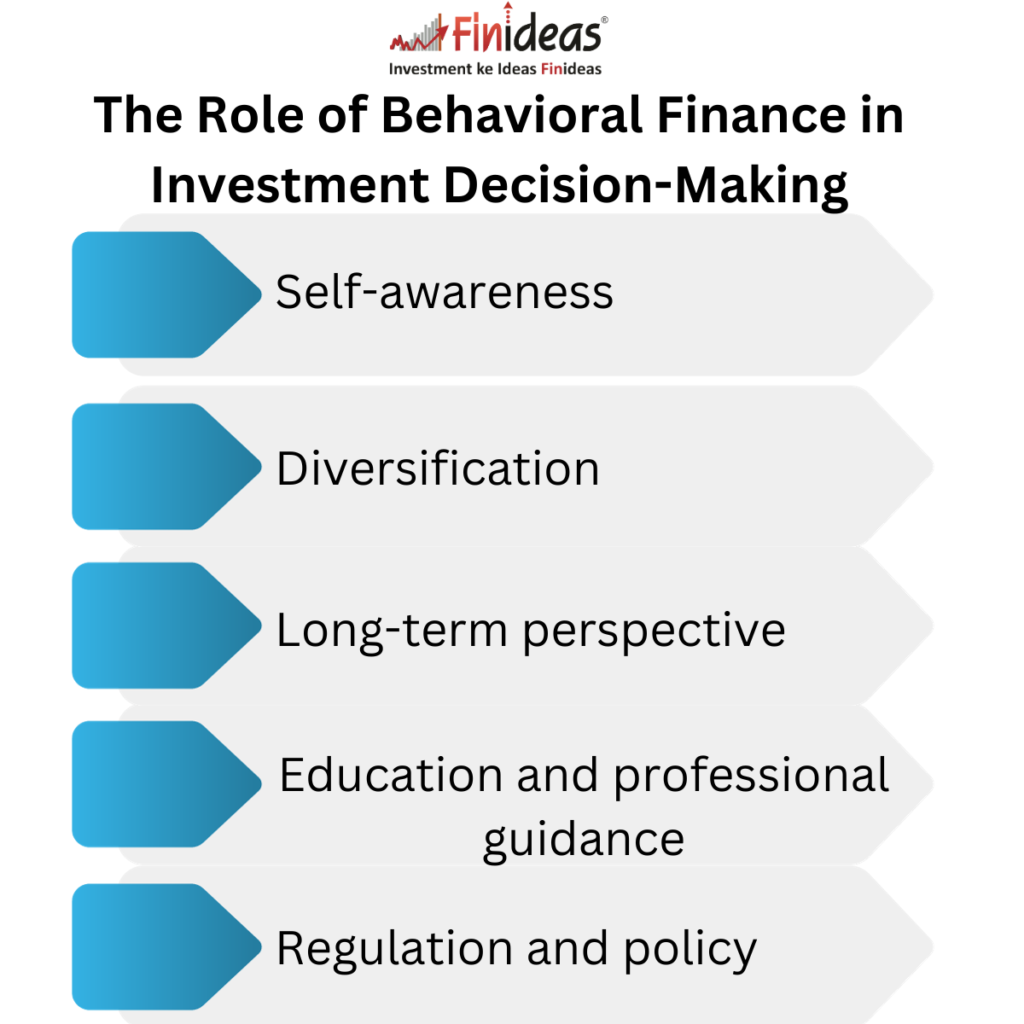

The Role of Behavioral Finance in Investment Decision-Making

Now that we’ve explored some of the key concepts in behavioral finance, let’s delve into its role in investment decision-making. Behavioral finance provides valuable insights for investors, financial advisors, and even policymakers.

Have you ever made an investment decision based on emotions or the influence of others? Share your experience in the comments section.

- Self-awareness: Understanding one’s own behavioral biases is the first step to becoming a more rational investor. By recognizing how emotions and biases can impact decision-making, individuals can take steps to mitigate these influences.

- Diversification: Behavioral finance emphasizes the importance of diversifying one’s portfolio to reduce risk. Diversification can help mitigate the impact of impulsive decisions driven by emotions or cognitive biases.

- Long-term perspective: Behavioral finance encourages investors to take a long-term view of their investments. By focusing on the bigger picture and avoiding knee-jerk reactions to market fluctuations, investors can potentially achieve more favorable outcomes.

- Education and professional guidance: Financial advisors can play a crucial role in helping investors make rational decisions. They can provide guidance, act as a counterbalance to emotional decision-making, and keep clients informed about the potential pitfalls of behavioral biases.

- Regulation and policy: Behavioral finance research can also inform regulatory policies designed to protect investors. For example, policies that promote transparency and disclosure can help counteract the effects of misleading information or overconfidence.

If you are in for long time i.e you are in it to win it then you must visit Index Long Term Strategy and can also contact us.

In conclusion, the field of behavioral finance offers valuable insights into the complex world of investment decision-making. By acknowledging the impact of emotions and cognitive biases, investors can make more informed choices. Self-awareness, diversification, a long-term perspective, education, and regulatory policies all play essential roles in mitigating the negative effects of behavioral biases. Remember, successful investing requires not only understanding the markets but also understanding oneself.

How do you think awareness of behavioral biases can improve your investment decisions? Share your thoughts below.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.