Financial Independence Retire Early (FIRE): Is It Achievable for You?

Introduction:

In recent years, the concept of Financial Independence Retire Early (FIRE) has gained significant traction. Promising freedom from the traditional nine-to-five grind, FIRE advocates saving aggressively and investing wisely to achieve financial independence at an early age. But is it a realistic goal for everyone? Let’s delve deeper into the world of FIRE and explore whether it’s achievable for you.

What is FIRE?

Financial Independence Retire Early (FIRE) is a lifestyle movement aimed at achieving financial independence and retiring early, typically in one’s 30s or 40s. The core idea revolves around saving a significant portion of your income, often 50% or more, and investing it intelligently to generate passive income streams that can sustain your desired lifestyle indefinitely.

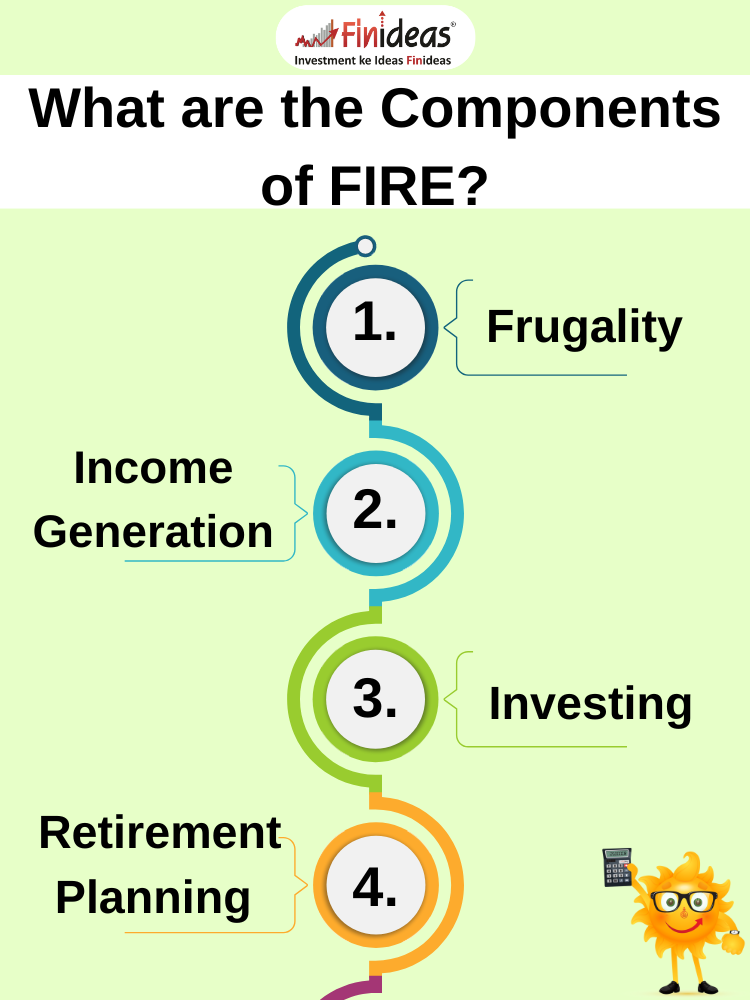

What are the Components of FIRE?

Frugality:

FIRE proponents emphasize living below your means, cutting unnecessary expenses, and embracing a minimalist lifestyle.

Income Generation:

Increasing your income through side hustles, entrepreneurship, or career advancement is crucial for accelerating your journey to FIRE.

Investing:

A key aspect of FIRE is intelligent investing. Strategies often include index fund investing, real estate, and other income-generating assets.

Retirement Planning:

FIRE isn’t just about quitting your job; it’s about designing a fulfilling post-retirement life that aligns with your passions and values. So if you are planning for your financial independence then you must know about Index Long term Strategy.

Is FIRE Achievable for You?

While the idea of retiring early and living life on your own terms is undoubtedly appealing, achieving FIRE isn’t feasible for everyone. Factors such as income level, financial responsibilities, and economic circumstances can significantly impact your ability to pursue FIRE.

What should be the Considerations Before Pursuing FIRE?

Financial Situation:

Assess your current financial standing, including income, expenses, debt, and savings. Determine how much you need to save and invest to achieve FIRE.

Lifestyle Preferences:

Evaluate your lifestyle preferences and determine if the sacrifices required to pursue FIRE align with your values and priorities.

Risk Tolerance:

FIRE often involves taking calculated risks in investing and career decisions. Consider your risk tolerance and ability to withstand potential setbacks.

Long-Term Sustainability:

Ensure that your FIRE plan is sustainable over the long term, accounting for factors such as inflation, healthcare costs, and unexpected expenses.

Conclusion:

Financial Independence Retire Early (FIRE) offers a compelling vision of freedom and flexibility, but it’s not a one-size-fits-all solution. Whether FIRE is achievable for you depends on various factors, including your financial situation, lifestyle preferences, and risk tolerance. Before embarking on the FIRE journey, carefully assess your goals and circumstances to determine if it aligns with your vision for the future.

What are your thoughts on the FIRE movement? Do you believe it’s achievable for you, and what factors do you think would make it more or less attainable in your situation?

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.