Understanding Finideas' Index Long-Term Strategy

Introduction:

Planning for a secure financial future, especially in an ever-changing economic landscape, is a concern for many. The Index Long-Term Strategy (ILTS) offered by Finideas is a comprehensive approach to wealth management that aims to provide both growth and safety for investors. In this blog, we will delve into the key components and principles of Finideas’s Index Long-Term Strategy, which strives to combine equity, safety, and prosperity.

Step 1: Invest in Index ETFs + Index Futures

At the heart of the Index Long-Term Strategy is a focus on investing in Index Exchange-Traded Funds (ETFs) and Index Futures. This strategy leverages the power of diversification by tracking market indices like Nifty50, which represent a portfolio of the top 50 companies in the Indian stock market. The advantage of investing in indices is that they have historically shown steady growth over the long term. This approach allows investors to participate in the broader market without picking individual stocks, reducing the risk associated with stock-specific movements.

Step 2: Purchase Protection of Investment

One of the unique aspects of ILTS is the emphasis on protecting your investment. In the world of investing, risk management is crucial. The strategy employs futures contracts to provide a safety net against market downturns. These futures can act as a form of insurance, helping to protect your investment from significant losses in turbulent times. This approach is designed to provide downside protection, ensuring that your hard-earned money is safeguarded.

Step 3: Invest Balanced Money in Debt Funds

To further enhance the safety and balance of your investment portfolio, Finideas recommends allocating a portion of your funds to Debt Funds. Debt Funds are known for their stability and income-generation potential. By combining equity investments with debt, investors can achieve a balanced approach that manages risk while seeking steady returns.

Result: Prosperity

The ultimate goal of the Index Long-Term Strategy is to achieve prosperity. This strategy is tailored for long-term investors who seek to accumulate wealth over time while managing risk. By incorporating both equity and safety measures, investors are better positioned to withstand market fluctuations, beat inflation, and secure a prosperous financial future, including retirement planning.

Why Choose Index Long-Term Strategy?

1. Rich Retirement: ILTS aims to help you build the funds necessary to enjoy the kind of life you desire after retirement.

2. Beat Inflation: Inflation erodes the value of money over time. By participating in the stock market, you can potentially outpace inflation and preserve your wealth.

3. No Stress, Just Growth: ILTS is designed to help you navigate challenging market conditions with a focus on long-term growth.

4. Low Investment for Big Growth: By leveraging low-cost index investments and futures, you can potentially automate your wealth-building journey.

5. Invest Now, Pay Later: This strategy allows you to invest for your future without immediate financial constraints.

How to Invest in ILTS?

The recommended portfolio allocation for ILTS is as follows:

– Investment in Equity: 30 Lakhs

– Investment in Futures: 70 Lakhs

– Investment in Debt: 70 Lakhs

Cost considerations:

– Hedging cost: 5%

– Futures forwarding cost: 3.5%

– Gross Cost: 8.5%

– Income from Debt: 5%

– Net Annual Cost: 3.5%

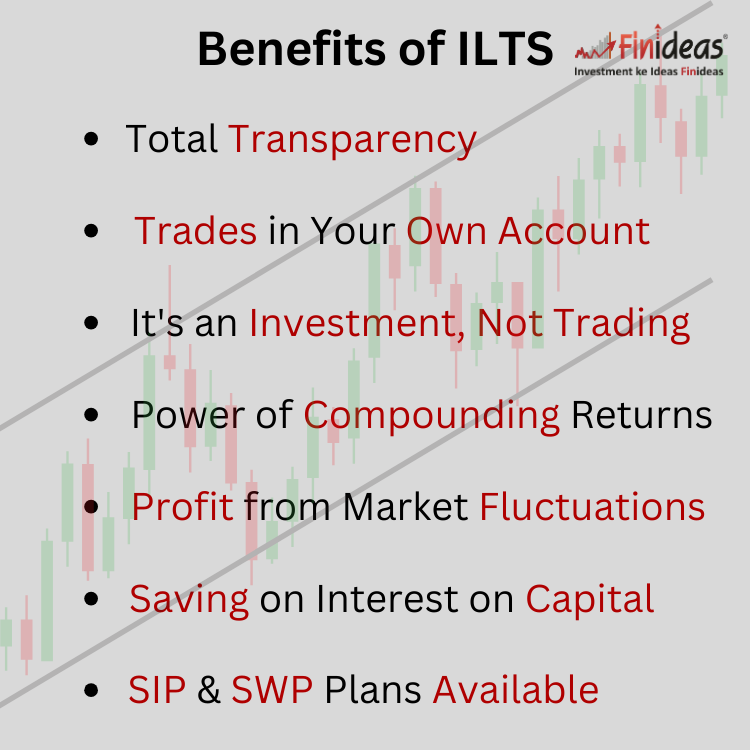

Benefits of ILTS

– Total Transparency: You have full visibility and control over your investment portfolio.

– Trades in Your Own Account: Your investments are made directly in your account.

– It’s an Investment, Not Trading: ILTS focuses on long-term growth, not short-term trading.

– Power of Compounding Returns: Over time, the power of compounding can significantly boost your wealth.

– Profit from Market Fluctuations: ILTS harnesses market fluctuations for potential gains.

– Saving on Interest on Capital: By minimizing the need for high-interest loans, you save money.

– SIP & SWP Plans Available: Systematic Investment Plans (SIP) and Systematic Withdrawal Plans (SWP) are available for investors to customize their approach.

For Whom Is ILTS Suitable?

The Index Long-Term Strategy is a versatile approach that caters to various investor profiles:

– Investors

– Traders looking for long-term investment options

– Financial planners seeking secure growth strategies for their clients

– Chartered accountants offering financial planning services

– Business owners aiming to generate passive income

– Salaried individuals planning for retirement and their children’s higher education

Conclusion

The Index Long-Term Strategy offered by Finideas is an innovative and robust approach to achieving long-term financial prosperity. By combining the benefits of equity investment, safety measures, and strategic debt allocation, ILTS provides a well-rounded solution for investors looking to secure their financial future. It offers the potential for growth while actively managing risk, making it a suitable choice for those planning their retirement or seeking to accumulate wealth over the long term. To secure your financial future, consider exploring the opportunities provided by the Index Long-Term Strategy.

Invest today and pave the way for a financially secure tomorrow with Finideas’s Index Long-Term Strategy.

What are your key financial goals, and how do you think the Index Long-Term Strategy could help you achieve them?

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.