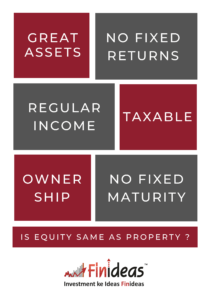

Similarity between Investment in Property and Equity

Property and equity are two highly sought-after asset classes for every investor who wants to invest their money. These offer attractive returns when are held for some time and you should seriously think of investing in them if you want to build wealth for yourself.

If you only want to invest in one and want to know which one to go for, then let us help you. We will start by looking at some of the similarities between investment in property and equity.

No fixed Returns

Investing in equity will not get you any guaranteed returns and neither will your investment in property. The profits that you will make from these investments will depend on the price at which you will sell these assets in the future.

Investing in either can get you losses as well. If the price drops below purchase price in the future price you will have to either book losses or hold on to the investment till the price moves up again.

No fixed maturity

Both property and equity have no fixed maturity date. So, you can choose your timing of exit when one of the following happens:

- When your target price is achieved

- When your targeted, a return is achieved. E.g. if you had expected a return of 20% from your investment, you may sell the asset as soon as you get a profit of 20%.

However, there is no guarantee regarding when this target price or target return will be achieved. Sometimes it may happen within 2 months and in certain cases, you may not get it even after waiting for 5 years. Hence, the exit from equity and property does not depend upon time and are totally dependent on the way the prices of these assets move.

Both can get you a regular income

The good thing about investing in equity and property is that you can get regular income from both while you wait for your targeted exit price to come. You can earn rent by letting out your property and you can earn dividends from the equity Investments.

Income from both are taxable

The income that you earn from both equity and property are taxable. In the case of property, you will have to pay long-term or short-term capital gains tax. Your income on equity may be classified as either business income or capital gains and you will have to pay taxes accordingly.

Ownership

You can buy both property and equities irrespective of whether you are an individual, HUF cooperative society, trust, partnership, or company. There is no restriction on investing in any of these asset classes in India.

Choose between property and equity depending on your risk profile and the liquidity that you expect. If you have the adequate funds, then investing in both is a great way of diversifying your portfolio and is highly recommended by us.

We, as a SEBI Registered Investment Advisor, recommend you to go with equity investment where you can get a good liquidity for your emergency needs. We are having a long term and short term investment plans for our clients with the hedging against market fall.