Why Is Discipline Important in Wealth Creation in India?

In India, wealth creation is often misunderstood as chasing quick returns or making risky investments. However, the real secret lies in discipline. The ability to stay consistent with your financial plan—regardless of market ups and downs—is what truly sets successful investors apart. Whether you are a young earner or an experienced professional, discipline ensures your money grows steadily and peacefully over time.

What Does Discipline in Wealth Creation Really Mean?

Discipline is about following a structured financial plan without getting distracted by short-term noise. Many people stop investing when markets fall, or withdraw early when they see temporary profits. This breaks the compounding cycle and delays long-term goals. A disciplined investor continues to invest, saves regularly, avoids emotional decisions, and patiently sticks to the process—even when markets test their patience. That’s the true path to wealth creation.

Can Discipline Beat Timing in Investments?

Yes, it can—and the numbers prove it. Let’s compare two investors. Investor A tries to time the market and invests ₹5 lakhs in one go every 5 years. Investor B invests ₹5,000 every month through a Systematic Investment Plan (SIP) for 20 years.

If both earn an average of 12% per year:

- Investor A’s ₹5 lakhs may grow to about ₹8.8 lakhs in 5 years.

- Investor B’s regular ₹5,000/month for 20 years grows to approximately ₹49.9 lakhs.

Clearly, consistent investing with discipline outperforms trying to time the market.

How Do Wealth Management Companies Encourage Discipline?

Wealth management companies in India offer structured investment advice that helps investors stick to their long-term goals. A good wealth management manager acts as a guide who reminds clients to stay calm during market dips and avoid unnecessary portfolio changes. These companies build customized plans, automate investments, and track performance—so that clients remain consistent.

Discipline is a foundational principle in every company wealth management strategy. Whether you are investing for retirement, children’s education, or financial independence, maintaining discipline is essential.

What Makes Finideas’ Index Long Term Strategy a Disciplined Approach?

Finideas offers a powerful solution through its Index Long Term Strategy, which is built on long-term discipline and simplicity. It allows investors to passively invest in India’s top 50 companies through the NIFTY 50 index. This approach does not require daily tracking or market speculation.

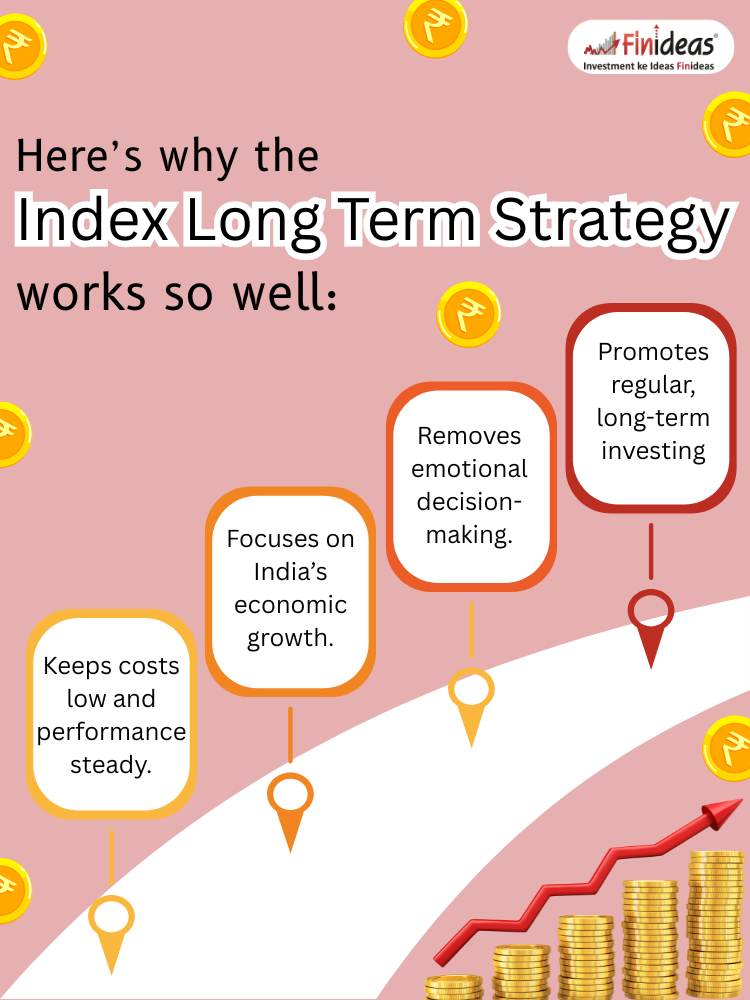

Here’s why the Index Long Term Strategy works so well:

If you’re looking for a wealth creation plan that’s simple, proven, and disciplined—this strategy should be at the top of your list.

How Can You Start Practicing Discipline in Your Financial Journey?

To begin, define a clear financial goal—such as accumulating ₹1 crore in the next 20 years. Then choose a reliable investment vehicle, like a low-cost index fund. Start small, even ₹1,000 per month is a good beginning. Automate your investments through SIPs so you don’t skip months. Don’t panic during market corrections. Instead, stay focused and consistent. You may also consult a wealth management manager to help you stay accountable and on track.

👉 What’s one disciplined financial habit you’ve started or want to start today? Comment below!

Happy Investing!

This article is for education purposes only. Kindly consult with your financial advisor before doing any kind of investment.