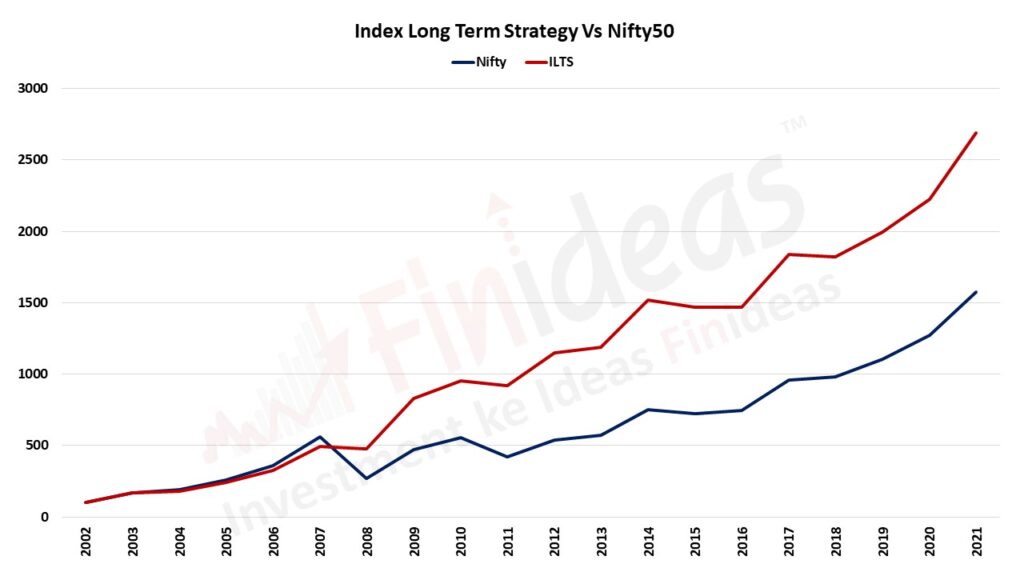

Index Long Term Strategy

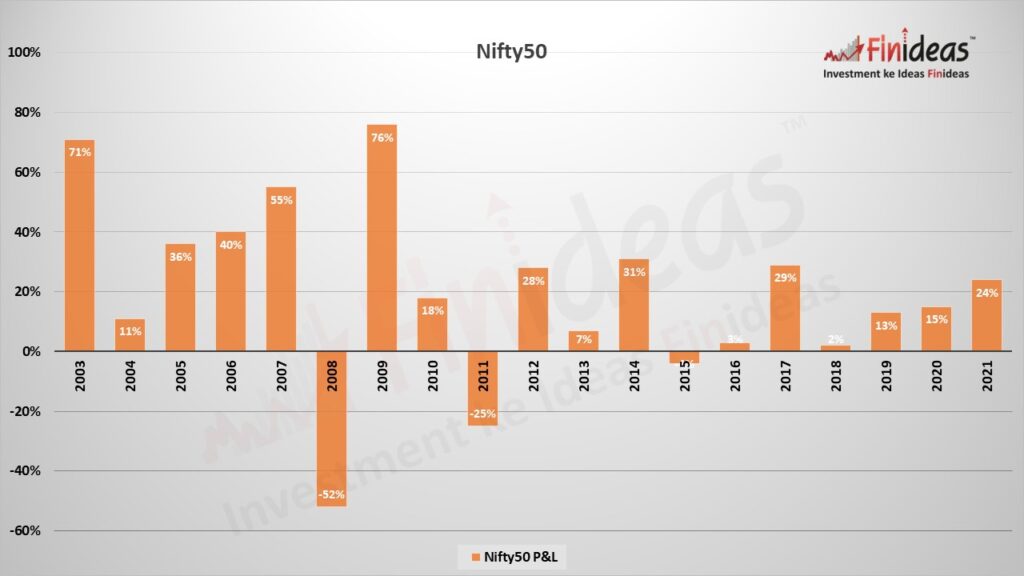

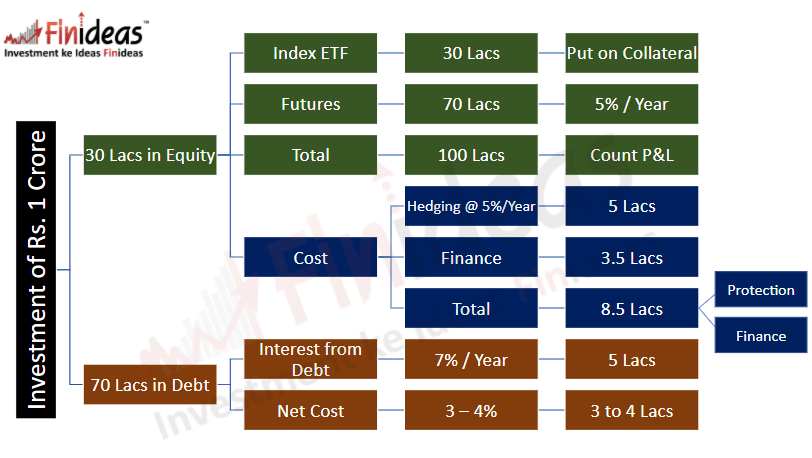

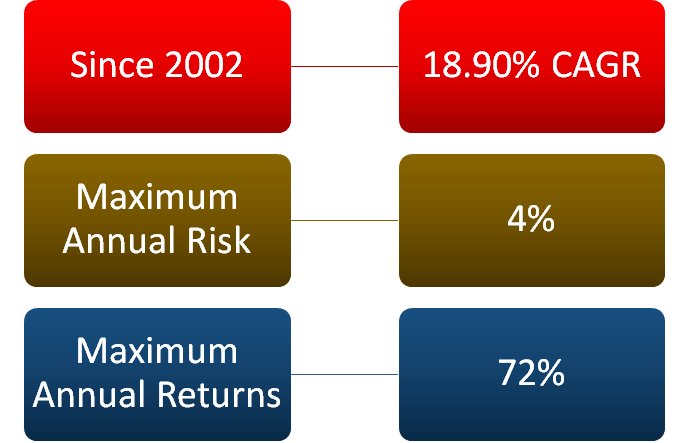

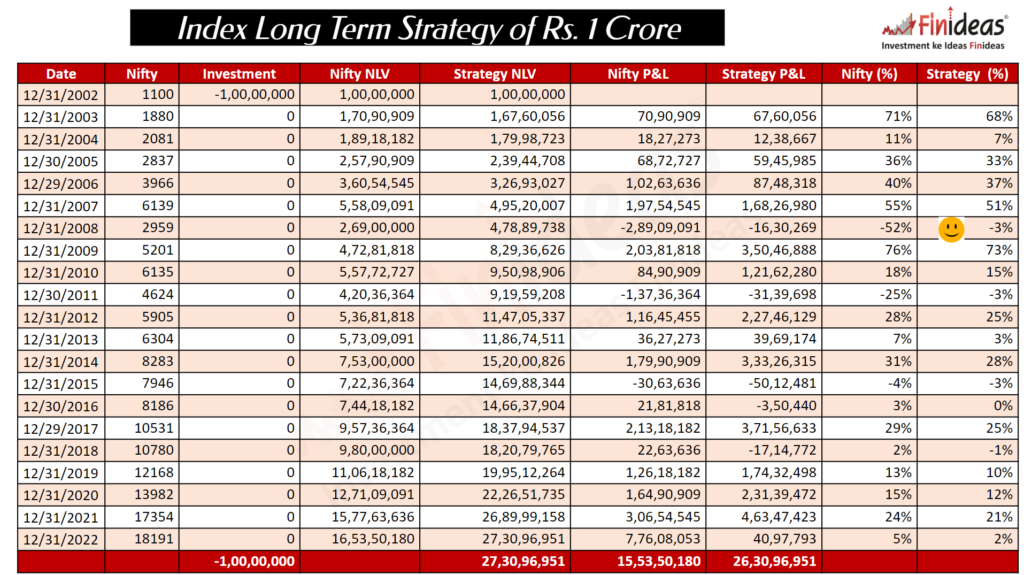

We are having many options for Investment in the equity market. Most of them vanish our wealth drastically when the market falls. Hence, we come with Index Long Term Strategy. Here, we invest in Nifty50 Index, take leverage through Futures and hedge with Options so that our wealth grow with market growth and get secured against market falls. Let’s understand each elements of Index Long Term Strategy one by one.