Getting Started with FinIdeas

KYC and Risk Profiling

Complete your KYC to set up your profile.

Plan Selection

Choose a plan that fits your financial goals.

Advisory and Reporting

Receive advisory, invest and track updates through your login.

Our Product

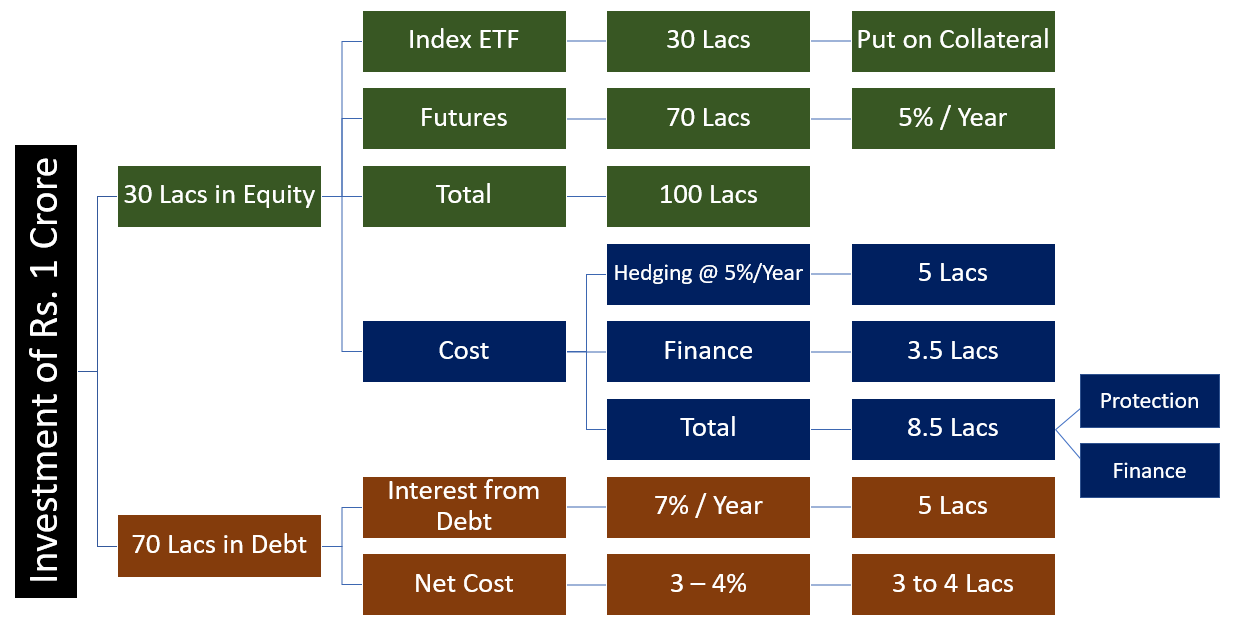

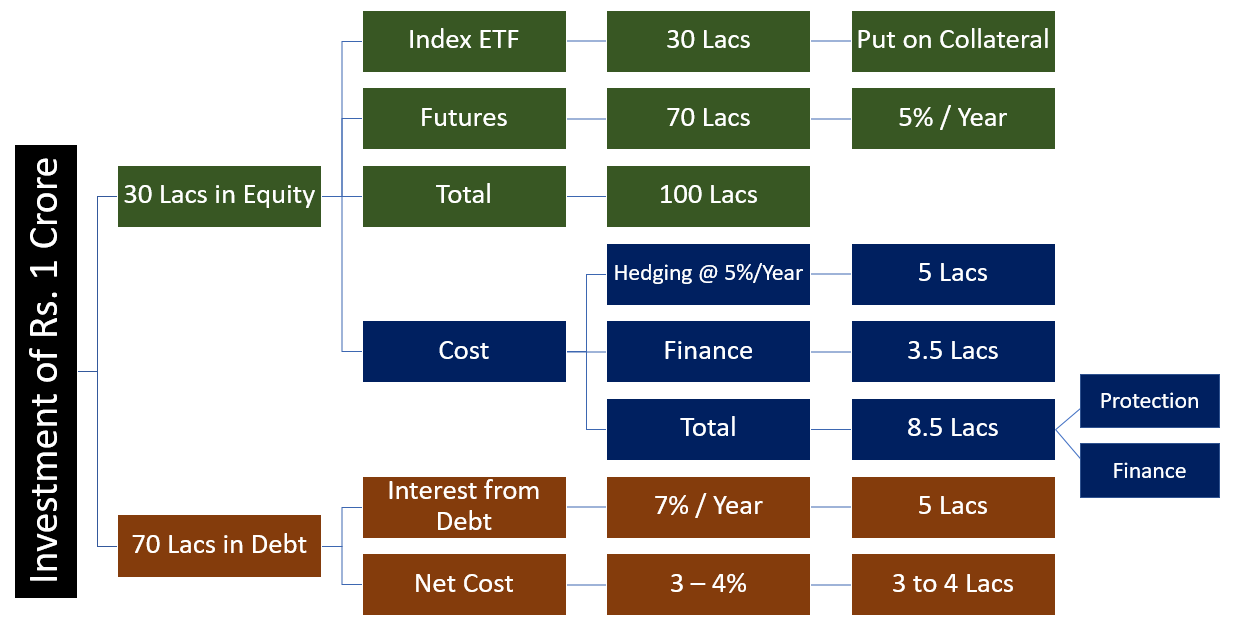

The Index Long Term Strategy (ILTS) is a structured investment approach designed for long-term investors seeking market growth with built-in protection. It blends equity, derivatives, and debt to balance returns and safety.

Grow your wealth with smart, balanced strategies. Secure, diversify, and protect—your future starts here.

Portfolio of top 50 companies. Never becomes zero. Consistently growing assets. Self Managed.

A part of the investment is invested in Debt to earn interest arbitrage.

Protects against market downturns. Provides low-cost insurance. Ensures cash flow stability.

Smart Hedging

*Above cost may change from time to time.

Smart Hedging

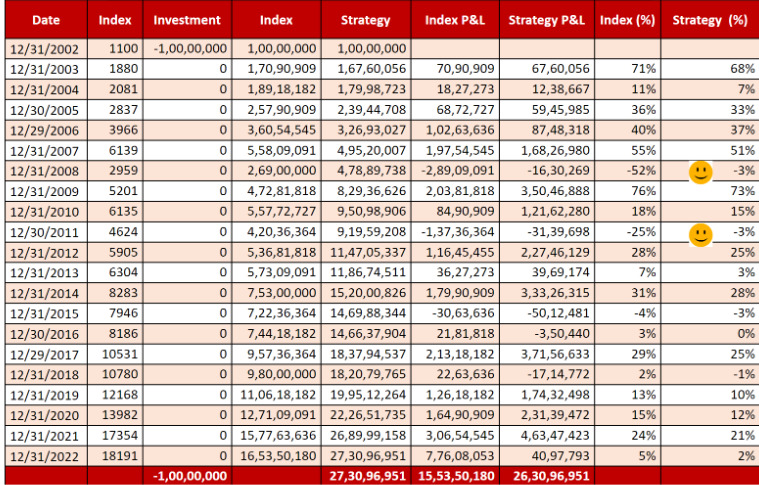

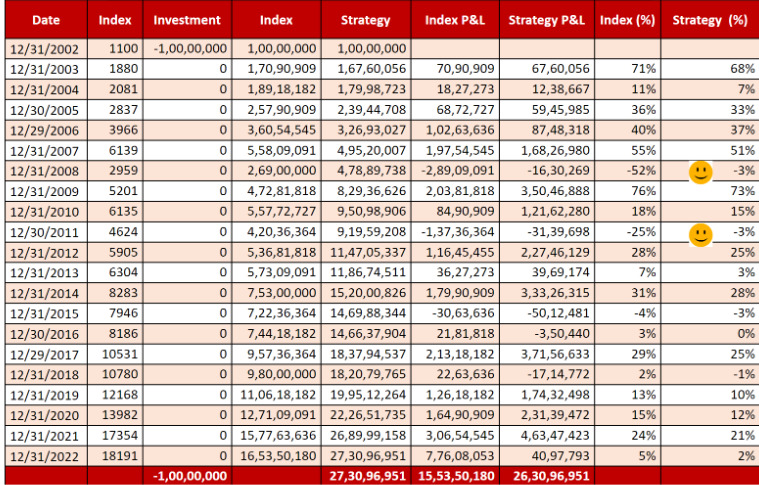

*Note: The above results has been arrived on the basis of past data testing. We took the data from the website of NSE. We assumed the interest rate at 9%, annual Put options cost at 5% per annum, Future forwarding cost at 5% per annum and Advisory fees at 1.25% per annum. The Strategy has delivered an 17.90% CAGR since 2002. with a maximum annual risk of 4%. The maximum annual return we gain is 72%. ₹1 Crore invested with Index Long Term Strategy in 2002 became ₹31.72 Crore in 2023.

Where Algorithms Meet Experience—Smart Investing for Retirement, Education & Beyond.

Combination of Equity & Futures with Hedging

Calculated Risk

Index Based Strategy

Low Risk Profile

Strong Past Record

Systematic Withdrawal is Possible

No Lock-in Period

Logical Period of Investment: 5 to 10 Years

Dedicated Team

Systematic Advisory through Algorithms

Planning Retirement & Higher Education

Ownership & Control in Investor's Hand

Empowering Every Investor — From Individuals to Institutions — With Secure, Structured Wealth Growth.

We craft long-term investment strategies that protect and grow wealth across generations while ensuring stable returns and financial security.

We simplify investing in India, managing compliance, currency risks, and high-growth opportunities to strengthen financial portfolios.

We provide tailored investment solutions for HNIs that maximize growth, ensure wealth preservation, and manage market risks effectively.

We help businesses optimize surplus funds with intelligent investment strategies that drive growth while mitigating financial risks.

Complete your KYC to set up your profile.

Choose a plan that fits your financial goals.

Receive advisory, invest and track updates through your login.

To learn more about how the Index Long-Term Strategy (ILTS) works and how it can benefit your investment journey

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |