FD vs Equity Returns: Fixed Deposit Interest Rates vs Market Growth

What Is the Difference Between FD and Equity Returns?

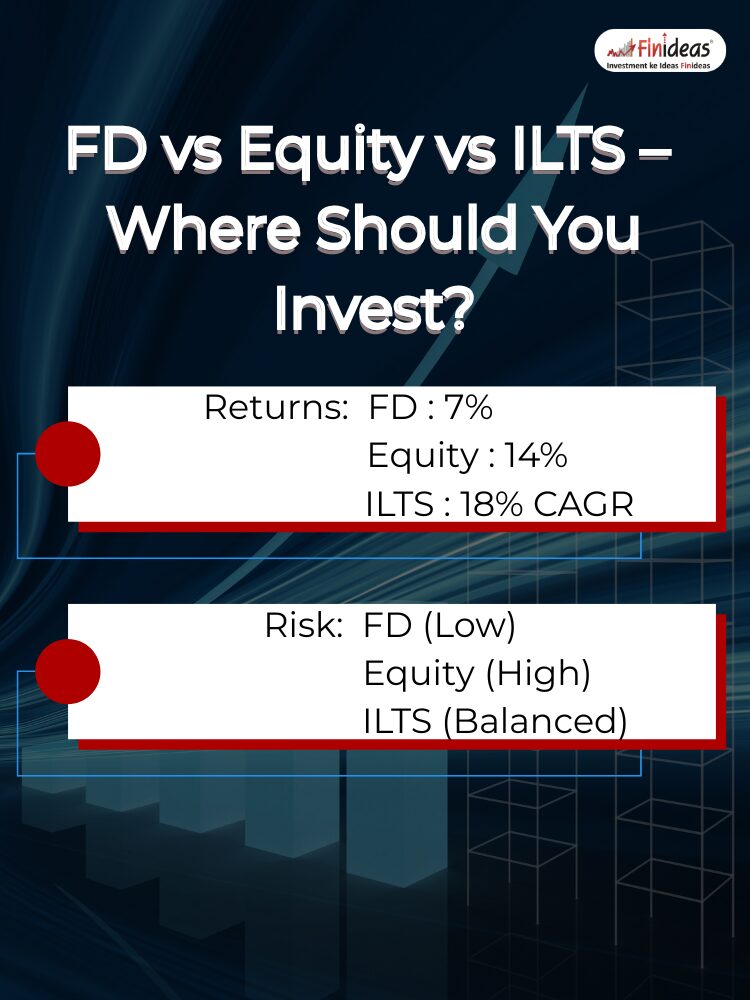

Are you confused between choosing a Fixed Deposit (FD) or investing in Direct Equity? Let’s compare FD interest rates with equity returns and help you decide where your money grows better.

What Is a Fixed Deposit (FD) and How Does It Work?

A Fixed Deposit is a popular investment option where you deposit money with a bank at a fixed interest rate for a fixed time. You earn interest at regular intervals, and the principal is returned at maturity.

✅ Example:

If you invest ₹1,00,000 in an FD at 7% annual interest for 5 years:

Maturity Amount = ₹1,40,255

FD Returns = ₹40,255

What Are the Current Fixed Deposit Rates in India?

| Bank | FD Interest Rate (1-5 Years) |

|---|---|

| SBI | 6.5% – 7% |

| HDFC Bank | 7% |

| ICICI Bank | 7% |

| Indian Bank | 6.8% – 7.25% |

| Kotak Mahindra Bank | 7.2% |

👉 Looking for the highest FD rates? NBFCs and small finance banks may offer 7.5% to 8% for longer tenures.

What Is Direct Equity and How Does It Generate Returns?

Direct equity means investing in stocks of companies. Your profit comes from stock price increases and dividends.

✅ Example:

If you invest ₹1,00,000 in the stock market with 14% CAGR over 5 years:

Maturity = ₹1,92,000

Equity Returns = ₹92,000

Equity returns are variable and depend on market conditions.

What Is the Return on Equity (ROE)?

Return on Equity (ROE) is a financial ratio that measures how effectively a company generates profits from shareholders’ money.

High-ROE companies often deliver better long-term equity returns.

FD vs Equity: Which Gives Better Returns Over Time?

| Feature | Fixed Deposit (FD) | Direct Equity |

|---|---|---|

| FD Returns | 6% – 7.5% p.a. (fixed) | 12% – 18% CAGR (variable) |

| Risk Level | Very Low | High |

| Taxation | Interest taxed per income slab | LTCG > ₹1L taxed @10% |

| Liquidity | Lock-in, penalty on withdrawal | Can sell anytime |

| Control | No control | Full control on stock choices |

Is It Safe to Rely Only on FD Returns?

FDs are safe but may not beat inflation. For long-term financial goals, relying only on FD returns could lead to wealth erosion in real terms.

Can You Get the Best of Both Worlds?

If you’re looking for stable returns with market-linked growth, consider alternatives like:

🔒 Index Long Term Strategy (ILTS)

- Managed strategy investing in index with hedging

- Potential to earn 18–20% CAGR

- Safer than direct equity

- More rewarding than best fixed deposit interest rates

❓What’s Your Investment Style?

Do you trust FDs for safety, or are you exploring equity for growth?

👇 Comment below and share what works best for you.

Happy Investing!

This article is for education purpose only. Kindly consult with your financial advisor before doing any kind of investment.