How Protection Ensures the Growth in Equity Market

Investing in the Indian equity market can be rewarding, but it’s not without risks. Market volatility, global cues, policy changes, and investor sentiments can impact portfolio returns. So, the big question is – how can you grow your wealth in the stock market without worrying about major losses? The answer lies in one word: Protection.

Let’s break this down in simple terms and explore how protection plays a vital role in ensuring consistent growth in the equity market.

What Does Protection in the Equity Market Mean?

Protection in the equity market means using strategies to safeguard your capital against large market falls. This doesn’t mean avoiding risk completely — rather, it’s about managing the downside while staying invested for upside growth.

In India, tools like hedging using index options, diversification, and long-term strategies like the Index Long Term Strategy (ILTS) by Finideas are helping investors grow steadily, even in volatile conditions.

Why Is Protection Important for Growth?

Imagine you have ₹10 lakhs invested in the stock market. A 20% market fall would reduce your portfolio to ₹8 lakhs. Now, to recover and reach back to ₹10 lakhs, your investment has to grow 25%, not 20%! Losses hurt more than gains help.

But if you had a protection strategy in place — say, using Nifty index put options — your downside would be limited. This gives you the confidence to stay invested and enjoy the compounding benefits of equity over the long term.

How Can You Protect Your Investments in the Indian Equity Market?

Here are some effective ways:

- Use of Index Options: Hedging your portfolio with Nifty or Bank Nifty options can cap your losses during a market crash.

- Diversification: Invest across different sectors to balance risk.

- Disciplined Exit Plans: Stop-losses or rebalancing at regular intervals.

- Long-Term Strategies: Like Finideas’ Index Long Term Strategy, which combines equity investment with built-in protection mechanisms.

What Is Finideas’ Index Long Term Strategy and How Does It Work?

Finideas’ Index Long Term Strategy (ILTS) is a smart investment plan where your money is invested in Nifty, and simultaneously protected using index options.

Example with One Lot (₹18,00,000 Investment in Nifty)

You invest ₹18 lakhs in Nifty (1 lot).

Simultaneously, Finideas uses part of the capital to buy protective puts.

- 📉 If the market falls, your loss is limited.

- 📈 If the market rises, you enjoy the upside (minus the minimal cost of protection).

✅ ILTS Benefits:

- Protection from market crashes

- Power of compounding in long term

- Peace of mind for investors

- Proven to outperform unprotected strategies during volatile phases

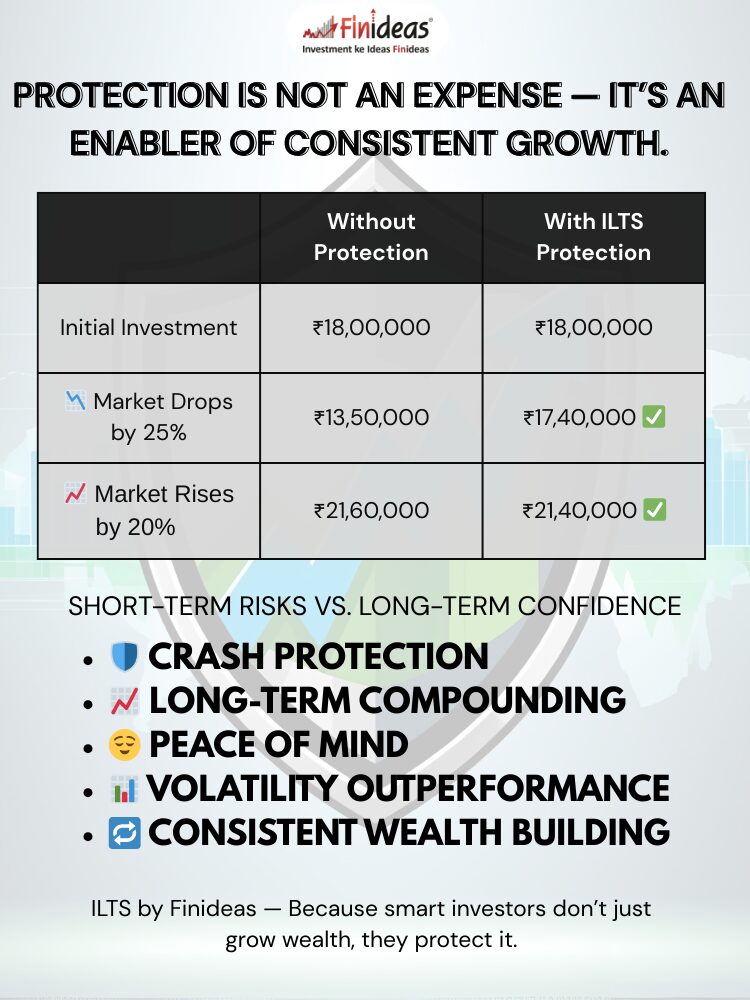

🔢 Real-Life Numerical Example:

| Scenario | Without Protection | With ILTS Protection |

|---|---|---|

| Initial Investment | ₹18,00,000 | ₹18,00,000 |

| Market Drops by 25% | ₹13,50,000 | ₹17,40,000 (limited loss) |

| Market Rises by 20% | ₹21,60,000 | ₹21,40,000 (after cost) |

As you can see, ILTS limits downside and captures most of the upside — giving investors both growth and security.

How Does Protection Help with Long-Term Growth?

By managing risk, protection:

- Keeps your money invested longer

- Reduces panic selling during market dips

- Allows you to benefit from compounding

- Builds wealth steadily and confidently

This is especially important in the Indian context where markets are influenced by election results, RBI policies, FIIs flows, and global news.

Protection strategies help investors stay calm and confident during market fluctuations. Instead of exiting the market in fear, you stay invested, which is the key to long-term wealth creation. In India, where volatility is part of the game, strategies like Finideas’ Index Long Term Strategy are becoming the preferred way to grow wealth safely.

Have you ever used any protection strategy in your equity investments? If yes, what was your experience? Comment below!

Happy Investing!

This article is for informational purposes only. Please consult with a financial advisor before making any investment decisions.