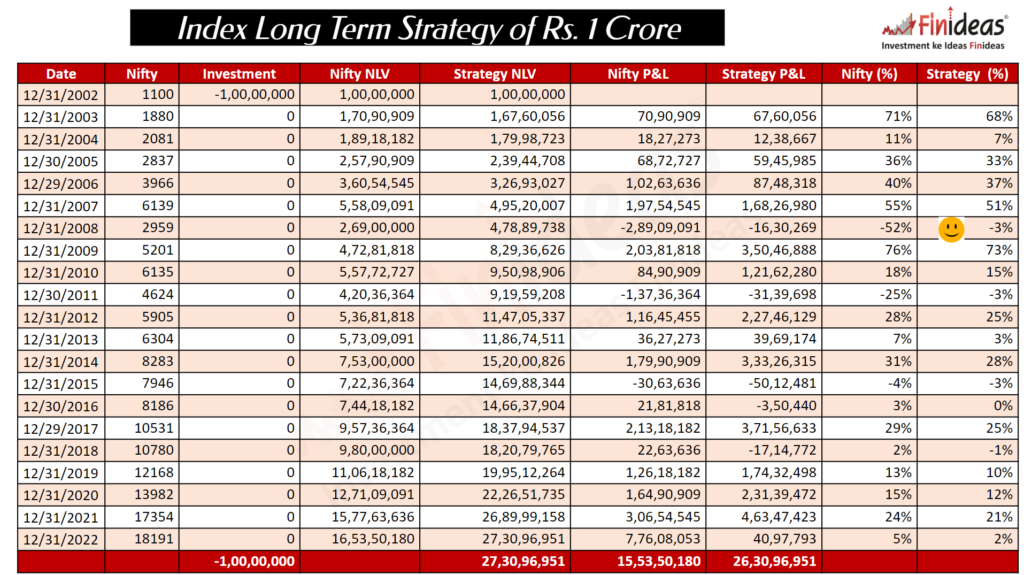

Index Long Term Strategy

Equity + Safety = Prosperity

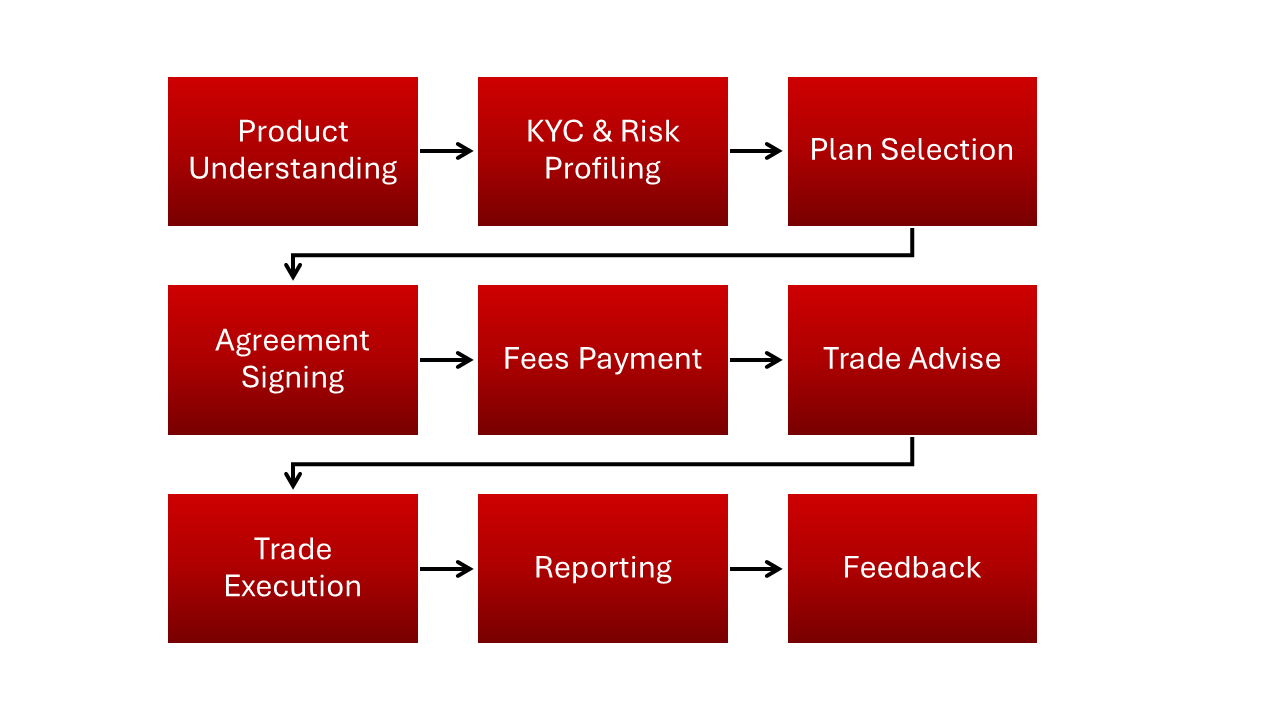

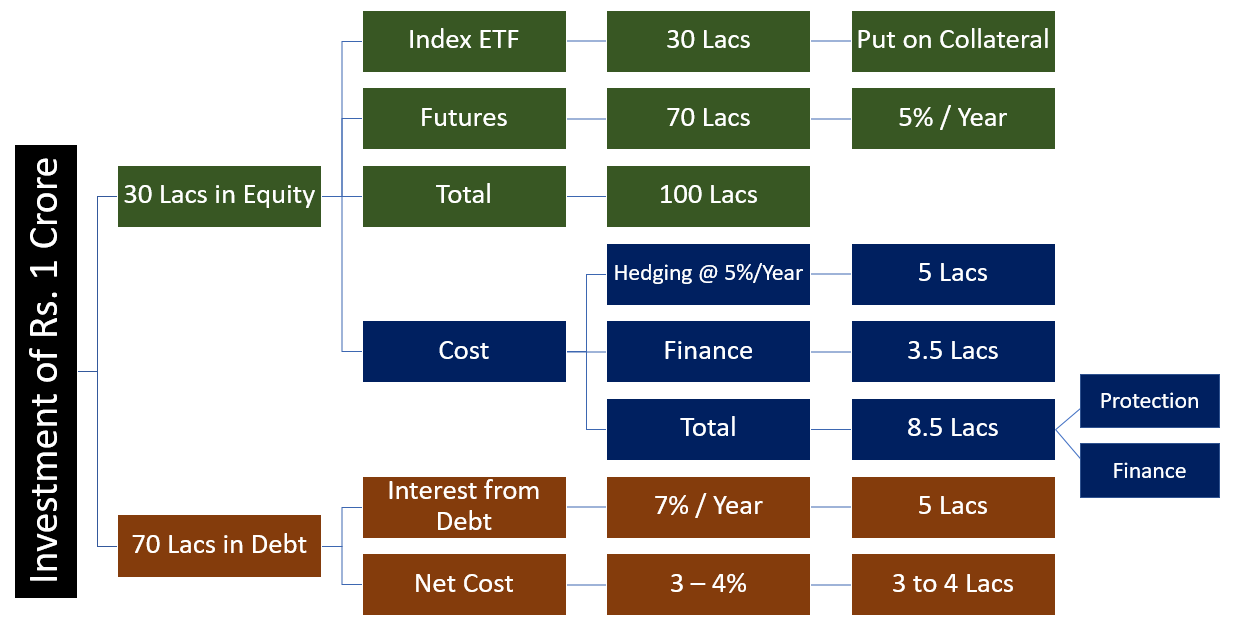

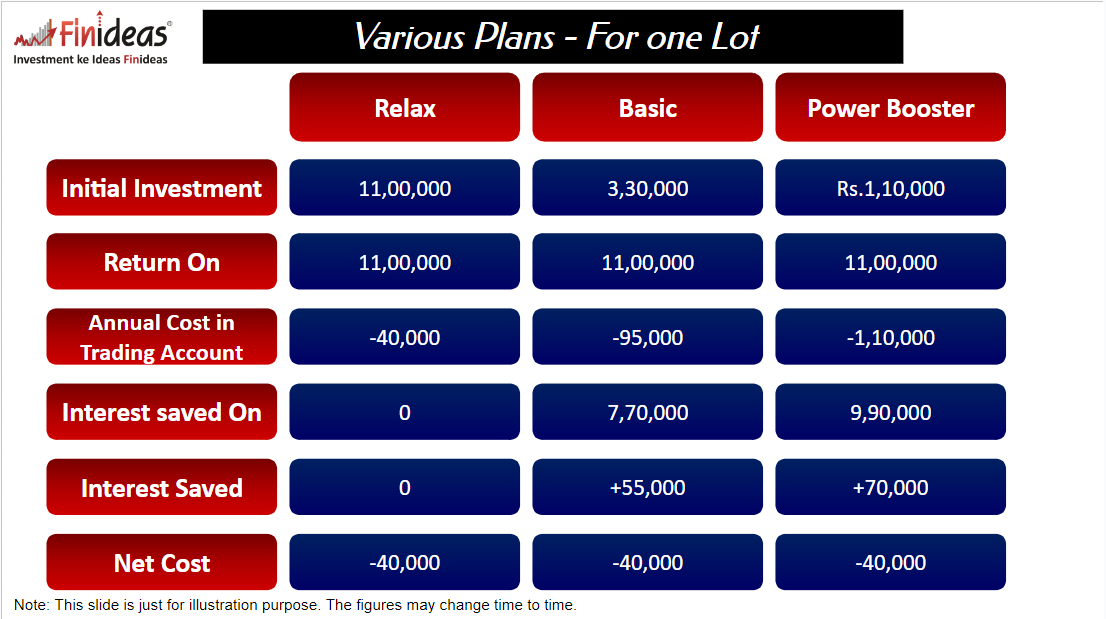

Step 1: Invest in Index ETFs + Index Futures

Step 2: Purchase protection of Investment

Step 3: Invest balanced money in Debt Funds

Result: Prosperity

Plan your retirement

Invest in Index Long Term Strategy, Today.